Welcome to the Lost Decade

The End of Easy Money from Stock Markets

It has been 17 years since the last real global recession struck the world. Yes, the Financial Crisis and the Great Recession of 2007/8 was the last time economies around the world recalibrated towards reality after speculation had run rampant in the housing and mortgage industries. The little dips we had along the way from then until today weren’t recessions - they were mere dips on the path of the longest bull market cycle in history. The so-called Covid Crash was not a recession, it was just a dip and was ultimately a great buying opportunity.

Those of you 40 years old or older understand the challenges that an actual recession brings forth. If you are 50 years or older, then you would have been in the workforce during the 2000 recession that followed the Dot Com Bubble and subsequent crash. Actual recessions are painful - people lose their jobs. Money becomes tight. Anxiety runs high. Security evaporates and uncertainty reigns supreme. It’s all very unpleasant.

Due to the elongated and record breaking length of this bull market cycle, many of the younger generations of working professionals have never experienced an actual recession - they have only witnessed an economy and stock market that only goes up. The challenge for them is, no matter how much they read about the past, there is no emotional sealant to memories that experience provides leading to a distorted and emboldened perspective of reality.

This distortion applies to all generations, as no generation lives forever. People who are in their 60s and 70s today have no recollection of World War II - just words and images that they have consumed. And nobody today truly understands what a Great Depression is like since that occurred more than a hundred years ago. We are about to repeat these events, starting first with the coming recession.

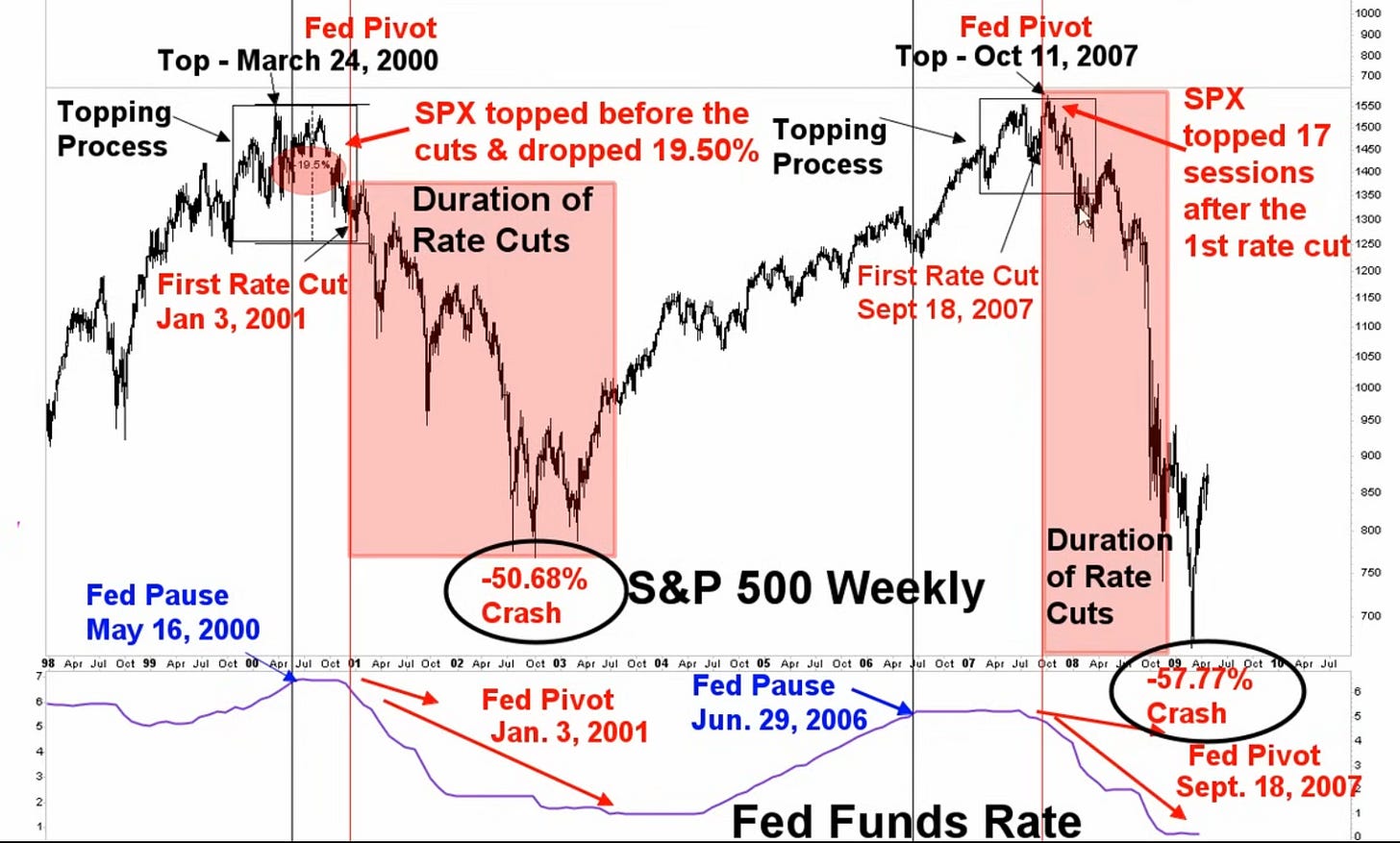

The last two real recessions were precipitated by market crashes shown above in the pink shaded areas. The key point here is that they both occurred soon after the Fed started cutting rates and ended a rate hiking cycle, as shown by the bottom part of the chart. Those who have not lived during these recessions have been Pavlovian trained to believe that the markets can only go up once the Fed starts cutting interest rates lower. Clearly, that is not always the case, especially after the Fed pivots and starts reversing rate hikes and starts to cut them.

Fast forward to today, and what do we see? The Fed cut rates on Sep. 18 after a raising cycle to combat inflation. This happened as well back in 2007, when the Fed pivoted and started cutting rates on Sep. 18 that year. Back then, the markets continued to go up until making a top on Oct. 11, 2007 - 17 trading sessions later. This year, the SPX made a top at 5,878.46 on Oct. 17, 2024, 22 trading sessions later.

Most may not realize it yet, but it is very possible that we have seen the top of the SPX last Oct. 17, some two weeks ago.

If that is the case, then just like before, expect the Fed to continue cutting rates as we enter a bear market complete with a crash or two. The outcome will once again dispel the myth that Fed rate cuts save the market from crashing - it doesn’t, it simply lays down the fuel for another bubble to form once the crash completes on its own.

There are a whole slew of factors that I’m carefully monitoring to help guide me through the complicated journey ahead. I will discuss them in my next YouTube video I’ll post later (subscribe to my channel here to get notified: https://www.youtube.com/@foftylife) but there is one that I will discuss here in this post: the bond market.

In an inexplicable and very troubling development, the bond market is doing exactly the opposite of what the Fed anticipated. The whole point of the Fed cutting its reserve rate is to lower interest rates, to get the market and economy moving again, and to prevent a recession or worse, a depression. However, ever since the Fed pivoted and started cutting rates, the bond market has collapsed and the yield, which is the real interest rates that the markets operate on, have skyrocketed.

This is extremely worrisome - the Bond market, which is three to four times larger than the stock market, doesn’t believe the Fed and is saying that it expects the Fed to end up raising rates, likely due to a return of inflation. In other words, the Fed cut rates too early, and inflation will return with a vengeance. The other narrative is that the US fiscal debt, now at over $35 Trillion and growing exponentially higher, has reached event horizon from which there is no return. Whether it be the former or the latter, neither narrative is welcome.

Goldman: we are entering a Lost Decade

Now, I’m very skeptical of what Goldman Sachs releases to the public, especially general news that isn’t reserved for its top-shelf clients from their proprietary trading desks. However, from time to time, they will make a long term macro announcement that lowers manipulation and conflict of interest thresholds due to the long time frame involved - in this case, 10 years.

These are rare instances indeed, because I actually agree with them. Nominal returns of 3% will be negative in real terms due to the return of inflation sometime in the coming years. The days of just buying an index fund and forgetting about it are over. Other asset classes, like Gold, will continue to hold value.

The old adage of “It’s not about timing the market, but time in the market” is about to get crushed. If you don’t believe me, just ask the Japanese who waited over 30 years to see their investment return to par (and in real terms still underwater due to inflation).

If you’re like me and 50 years old, that’s not a time frame that is digestible.

Which is why I have my own plans, and am willing to share it with the few of you who join me.

Stay alert, don’t blindly listen to the mainstream media, exercise your own critical thinking, and be prepared.