Time is Running Out (Part 3)

Fortifying your financial configuration to weather the incoming storm

Yesterday, Jerome Powell took the stage at the annual Jackson Hole gathering and announced that the time has come to cut interest rates.

You should be petrified. I am.

Let me give you the simple reason that slices through academic spaghetti like a katana blade: never in the history of the United States has the government begun to lower interest rates after raising them when asset classes were at all time highs. The reason is simple: lowering interest rates boosts economic activity and “heats” things up. It is medicine, or as steroid users say, the “juice” to resuscitate a lethargic economy - an economy that is in a recession or has suffered a major crash like in 2007/8, or when Covid hit.

We can throw all sorts of advanced economic / academic / jedi-mind-emic to fabricate reasons why this time is different but we can never change the laws of gravity itself. We are not God.

Boosting the economy up by giving it a hit while it is at all time highs is like handing a meth user keeled over on the street a loaded crack pipe - the dude is already high man!

What could possibly go wrong?

Well, let’s take a quick peek:

The stock market is at all time highs…

Home prices are at all time highs…

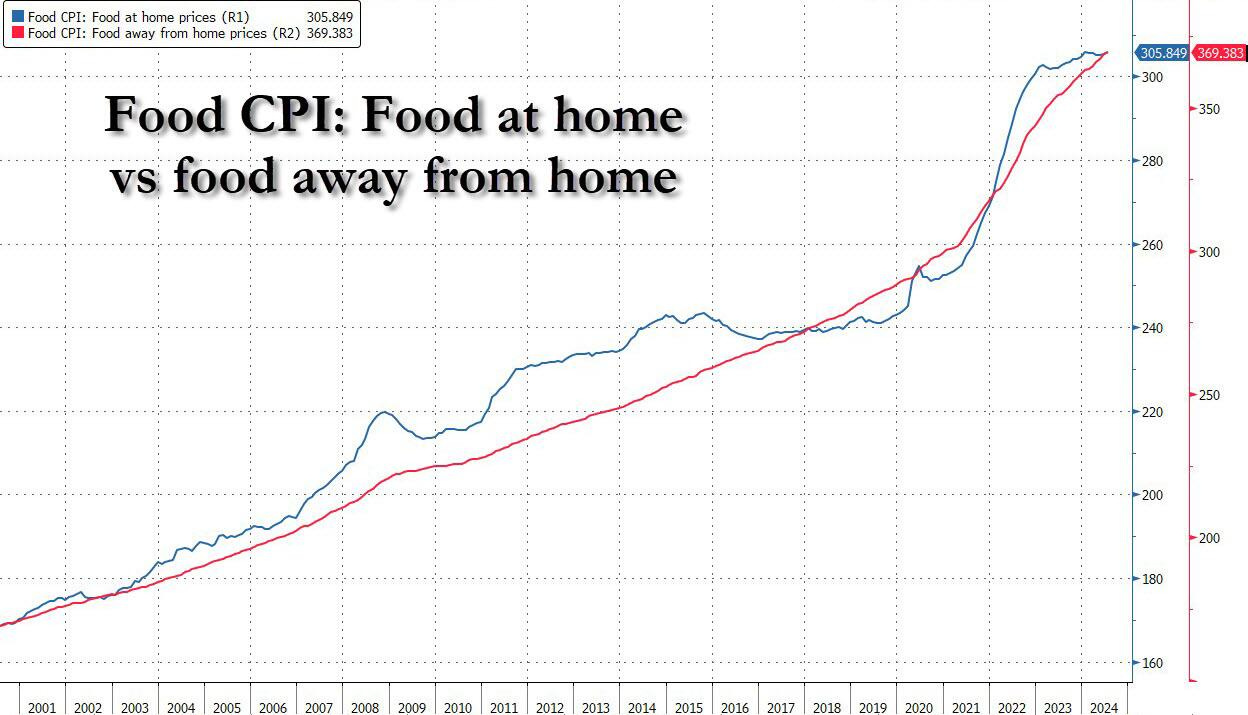

Food prices are at all time highs…

I think you get the drift here - why are we cutting interest rates to boost the economy when everything is already exploding higher?

This is the part we will avoid - there are a lot of other places to go online to engage in politics, speculation, and plans within plans. We’re not going to do that here. Instead, we are simply going to stick to the core topic at hand: so what does this mean for all of us?

There are only two outcomes heading out way…

Outcome #1 (the one we should hope for, and the more likely outcome):

We will have a recession that will be “announced” by main stream media in 2025. The recession will be deep and painful, resulting in significant job losses and economic activity slowdown.

This would be the base case if we are already in a recession and the government has been obfuscating data around it from us, at least until after the elections are over as 2024 concludes. Why it would do such a thing such as continuously revise jobs reports downwards during an election year (the last of which was the largest downward revision in over a decade), again - I will leave that to the many corners of the internet that provide a myriad of reasons.

Outcome #2 (the one we pray we will avoid):

The meth user, already high and almost completely detached from reality, decides to take a hit off the loaded crack pipe that was handed to him. He gets even higher for a bit, before his body suddenly short-circuits as he has an overdosing episode.

Before we write this off completely, let me remind you that this has happened many times in the past - the last one being the Great Depression in 1928/9 that plunged the world into severe hardship, eventually culminating into World War II and a new set of global orders that the winners - namely the USA and its allies - got to write. There is a reason why English is the internationally spoken language, and why the US Dollar is the world’s global reserve currency.

What that means is we would have a return of inflation with a vengeance, as whatever money we own and get paid with gets watered down as it loses its purchasing power in an ever accelerating pace. It is essentially stealth taxation gone wild, to finance insurmountable sovereign debt.

Everything will rocket higher, but whatever nominal numbers represented in prices won’t mean much as the value of the currency emasculates away.

Could there be a third option? One where, the Fed actually got it right and everything - literally everything - we are hearing from the main stream media is absolutely true? Technically, yes - but the chances would be less than Kanye West marrying Kim Kardashian again. Let me remind you, the Fed has never engineered a soft landing in the entirety of its existence. So in practical terms, no, there is real third option.

So then, what are we to do? How do we prepare for either option? Is there a way to prepare for both?

Well, this is where I must tell you - for legal reasons - that I am not a financial advisor. Go seek financial advice for a legally licensed financial advisor. All I can share with you going forward is what I’ve been doing for the past three years in preparation of whats to come.

There are five general principles that I have implemented, and continue to implement to this day:

Diversify income streams

Protect purchasing power

Reduce allocation of illiquid assets

Increase exposure to decentralized stores of value

Setup accessible local stores of physical value

I won’t cover the the typical “reduce your debt” revelations - you can go to many other places for that, or just call up Robert Kiyosaki after you read his Rich Dad Poor Dad book for the 50th time 😃

I’ll be going over these five principles in my next post, but do have a look at my previous post on this topic in the meantime over here:

Really nice reading your post and watching your videos Sang Shin. I’m in the process of figuring out the same stuff with what’s coming ahead. Will defnitely follow your future posts and videos 👌🏼