A Factory Reset of the World is Coming

The Quickening is Accelerating

Humanity is entering the final stages of a cycle that despite being repeated countless of times, remains stubbornly unfamiliar to most of us. The culprit behind this fascinating phenomenon is what I call Generational Amnesia.

Generational Amnesia is the result of a biological limiter: our age. Most of us will not live to be over 100 years old, and what that means is that we tend to repeat the mistakes of our forefathers because we did not experience the level of pain that they did. For example, there are not many people on the planet who were alive during The Great Depression that started in 1929 - anyone who was alive back then was just an infant at the time and did not fully comprehend what was unfolding as an adult. All the suffering, stress, and pain of that unfortunate episode has vanished, with only remnants in the form of pictures and text in existence today. No matter how much we read and study The Great Depression, we will never truly understand the painful lesson that was learned. There is no way to “experience” text and photos. Which is why we will inevitably repeat the same excesses and exuberance that led to that catastrophe.

Like any wave function, this generational cycle of about 100 years has sub-cycles within, roughly broken down into 25 year buckets that we understand as generations in today’s world: the Boomers, GenX, Millennials, GenZ and so on. A complete cycle comprises of four generations, with each generation representing a stage in the cycle: the Hero, Artist, Prophet, and Nomad generations. This is the thesis presented by Strauss and Howe in their Generational Theory, which I discovered after I arrived with a similar framework myself.

Now, I am not dogmatic about all the details that the Fourth Turning represents and the reason is that looking for uniformity by working backwards in history can be a biased process (e.g. confirmation bias), and I’m cautious of the pitfalls of retro-fitting historical facts to develop a narrative. Having said that, at a higher level, I absolutely do believe the existence of cycles that human civilisation repeats, and that one of the enablers is the limit to how long we live and the experiential knowledge that is lost as a result.

And I believe that we are coming to the end of a 100 year cycle today. The Financial and Geopolitical machinery of the world - which are tightly coupled - are in their last stages, and an impending reset is on the horizon. Like other resets in our past, the coming reset will be facilitated by a step-change in technology. In our episode, it is the Digitization of the world and resulting Machine Intelligence from the processed data that will accelerate and fuel the reset and transition of the Financial and Geopolitical machinery from the old to a new regime.

Act I: The end of the existing Global Financial Regime

Today, we are operating in the final stages of a financial system that was created at the end of World War II. Guess what, the winners get to write the rules, and that is why English is the internationally spoken language and not German. It is also why the US dollar is the so-called reserve currency that internationally traded goods and services are settled in. Nations that want to import oil, for example, must acquire US dollars first, and then use those dollars to then buy the oil they need in the global markets - that’s how the term Petrodollar came about (there are other variants such as the Eurodollar, etc.) This system has largely been in place since Bretton Woods and Bretton Woods II, with the de-linking of the US dollar from physical gold being the only major change in its configuration. President Nixon had to delink the US dollar from gold when the European nations came calling for the gold in exchange for their US dollars. Apparently, the US did not have enough gold it was willing to distribute because too much dollars had been printed out of thin air. Conveniently, the US technically defaulted and simply said there is no gold backing to US dollars anymore. That’s what a superpower resting on its laurels after winning a global war can do - instantly change the rules of the game.

Over time, this cycle has repeated over and over again - politicians looking to stay in power need to provide more and more services to the public to get re-elected, even if there is no budget for it. So money is printed out of thin air to finance these projects, which can include wars. Once all this money hits the economy and finds its way to the private sector, bubbles are formed in various asset classes. The blow ups and subsequent pops we’ve seen with the 2000 DotCom and 2007/8 SubPrime Mortgage episodes are recent incarnations of this process.

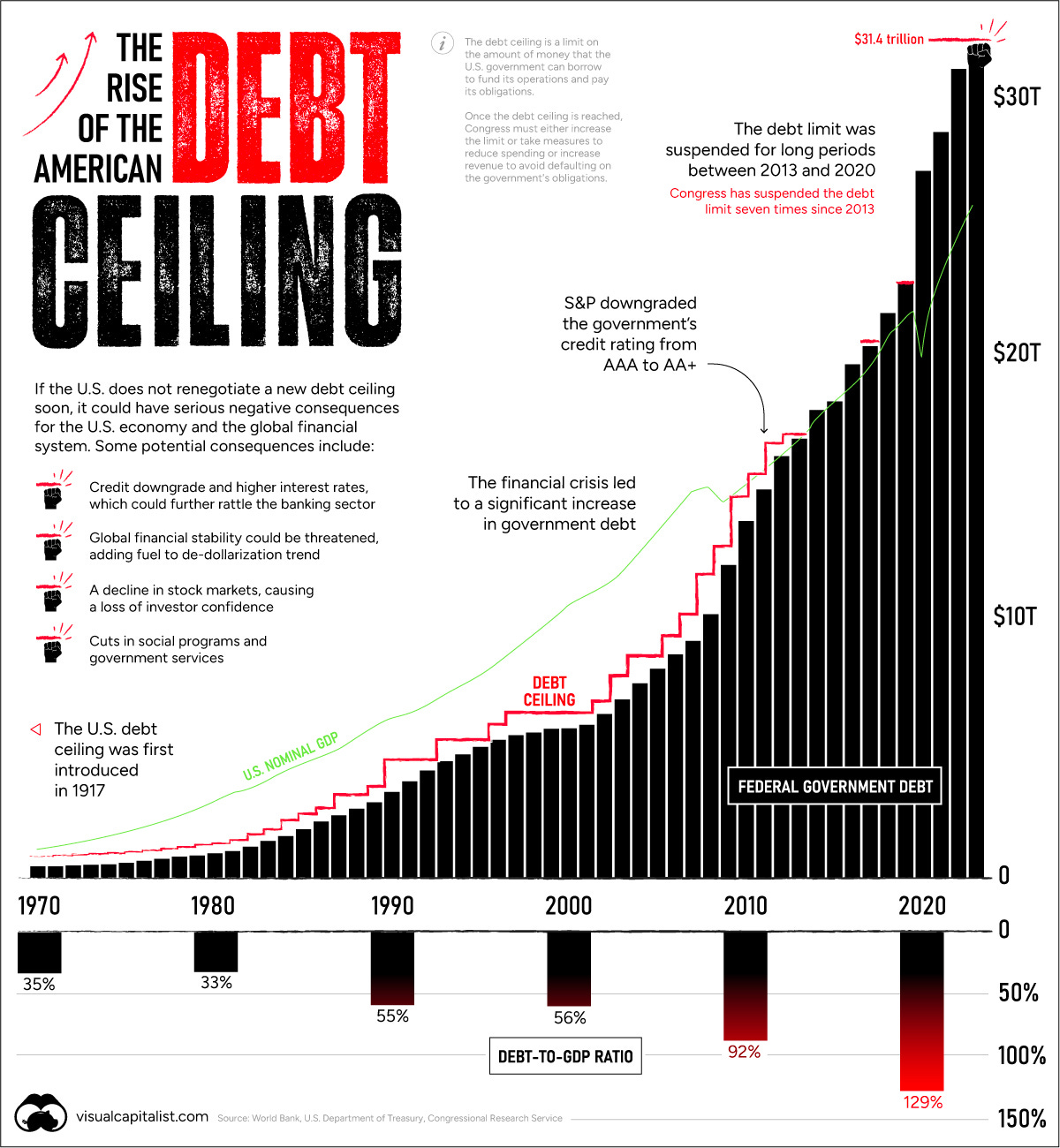

Eventually, this long term debt cycle makes its way to the national and public sectors, and sovereign debt bubbles are blown up. This is what to look out for, as it is a clear signal that the cycle is coming to an end. Now, many nations have already gone through this in recent times (e.g. Brazil, Japan, etc.) but the final curtain call comes when the superpower, and the nation holding the global reserve currency finally goes into a sovereign debt bubble. We are now in a sovereign debt bubble in the US. The total Federal Debt has exploded to $34 trillion, and with inflation running hot because of all the money printing going on (more money chasing the same number of goods and services), the Fed has no option but to raise interest rates to avoid runaway inflation. This in turn raises the cost for the government to service its debt, and the US is now paying more to service its debt interest than the entire defence budget each year.

This is clearly not a sustainable situation, and it is a strong signal that the sovereign debt bubble has reached escape velocity. The ultimate test? Nobody on this entire planet - not a single soul - believes that the US will ever repay its $34 trillion debt. If you don’t believe me, try to find someone of status who has gone on record - be it a politician, economist, or investor - and said that the US will repay the $34 trillion debt it owes (never mind the tsunami of healthcare and social security obligations lurking under the waters which remain off the balance sheet for now).

Act II: The end of the existing Geopolitical Regime

Here’s the thing: the game of inflation (e.g. increasing the supply of money or printing money out of thin air) in the name re-election can continue for a very long time. Once things go vertical, as it has with the US dollar money supply, there is no nominal level that foretells when it will all end or when the music will stop.

At the same time, there are markers that give clues, and those markers are generated by the Geopolitical activities of the world. The Financial system does not exist in a vacuum - instead, it is tightly coupled with the Geopolitical order of the world. In fact, it is frequently converted into a weapon in the early phases of the reset, as evinced by sanctions that the US and its allies impose on nations they consider as threats to the regime. The reserve currency status of the US Dollar and global banking system is effectively weaponized and facilitates the execution of these sanctions. When the US says it will cut off the sale of Iranian oil, it enforces this by banning the sale of Iranian oil on the global exchange, which as I’ve described, is settled in US dollars - the very instrument that the US owns and controls.

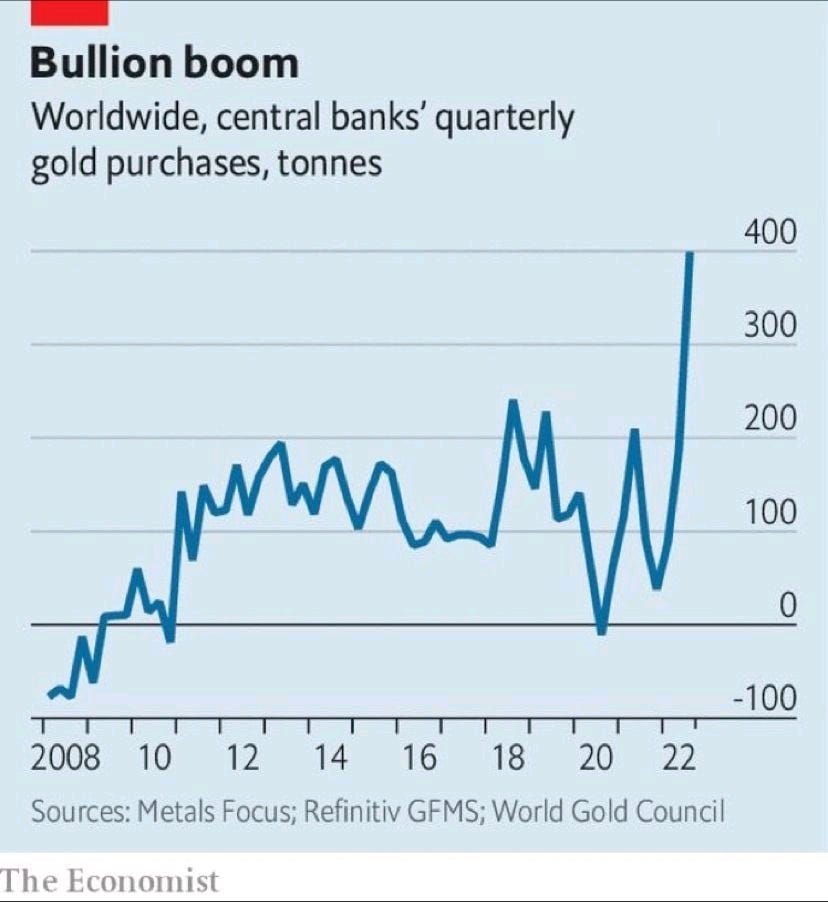

However, unlike the past, what we have witnessed is a bifurcation of the world where a new challenger has emerged: BRICS. What we have learned is that this BRICS alliance (Brazil, Russia, India, China, South Africa, Egypt, Ethiopia, Iran, and the United Arab Emirates) has developed its own global transaction system and is poised to challenge the existing regime. For all the sanctions that has been slapped on Russia as a result of its activities in Ukraine, the Russian economy has not only withstood but flourished because of this alternative global trading system with large enough partners. If you look at the member nations, you will quickly realize that it contains two of the most populous countries in the world and many commodity rich nations. It should then come as no surprise that Putin was recently re-elected with the highest rating and win margin in his life because Russia’s economy is doing well. These nations have eschewed the US Dollar and settled their trade in either direct currency swaps or in gold, with China storing the gold for member nations in its vaults. One of the side effects of this is the explosive appreciation in the price of gold which has reached new all time highs. If you look into who is buying gold, you will understand that it are the central banks of the world - BRICS or not - buying copious amounts. For example, Singapore’s central bank was the world’s 3rd largest buyer of gold in the year of 2023.

Ultimately, what this means is that the sanctions have failed, that the US Dollar is not as powerful the weapon it once was, and the stage is set for a challenger to compete for regime change.

All one has to do is scan the landscape to see how regional conflicts have dangerously escalated to a boiling point. Ukraine. Gaza. Now Iran. And soon to be, the South China Sea (Philippines) North Korea, and finally, Taiwan. The burners have been initiated in these regions, with some coming online and catching flames while others continue to steadily simmer in anticipation of combustion.

Each conflict on its own, while disastrous, could be managed independently but it is the bifurcation of the world into two camps where the integration of these conflicts is now made possible. As a result, the stage is being set, the musicians are tuning their instruments in the orchestra pit, and the crowds are filing into the auditorium to find their seats. Once the sides have been set and the supply chains and trading system are geared up, it will be left up to the strategists to determine the most opportune time to maximize the element of surprise and kick-off the military component of the global factory reset.

Bear in mind that Xi (70) and Putin (71) are effectively in power as long as they are physically and mentally fit to rule, and that they both have legacies they aim to leave (consolidation of historic Russian lands and reeling Taiwan back in). Both are about the same age and understand that they have a limited window of opportunity in their lives for the “right moment.”

This is why I believe we have a decade, but probably much less before the Reset button is hit.

Act III: Here Come the Digital Machines

With resets come the enablers in the form of breakthrough technology. Whether it be gunpowder, the industrial revolution, or nuclear energy, these step changes foment and accelerate change that unseats the incumbent regimes. In our era, it is the digitization of the world - including of us humans - and the resulting machine intelligence from the processing of all the digitized data.

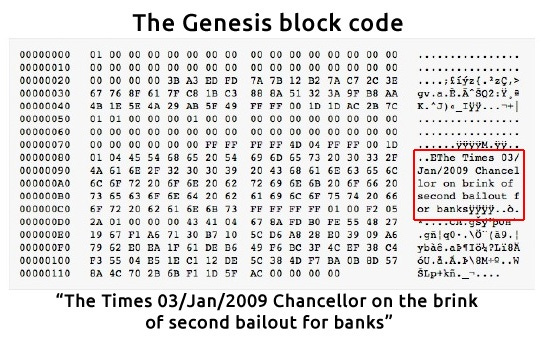

If we look at the blockchain technology and the invention of Bitcoin, we see the potential creation of a “digital gold” and an alternative to the current regime of currencies. One of the key capabilities of blockchain is the immutability of information put on the chain - essentially, once information is uploaded and written to the chain, it is forever etched and can never be altered, providing an indisputable archive of information. It should come as no surprise then that in Bitcoin’s “Genesis” block (e.g. the first block ever written), this immutable phrase is etched: “The Times 03/Jan/2009 Chancellor on the brink of second bailout for banks” - referring to the Mortgage Subprime debt debacle that resulting in the bailout of Too Big To Fail banks.

Inspired by these developments, central banks have created their own versions of digital currency called Central Bank Digital Currencies or CBDCs. These also operate using the same blockchain technology but jettison the decentralized approach. Instead, CBDCs are the ultimate form of currency control because they enable the ability to program the way each and every cent is spent by each and every citizen. For example, a central bank can program the currency in your account or wallet such that you wouldn’t be able to buy alcohol with it. It’s obvious where this is heading: control.

On the Geopolitical front, we have already witnessed how data and the rapid evolution of Machine Intelligence is becoming an increasingly powerful, and dangerous tool. We have to look no further than how information was conveyed, controlled, and leveraged to alter mass social behavior at a scale and at a speed that was previously unheard of. Whether it be the influence of elections, or the selection process of target sites to hit such as Israel’s “The Gospel,” machine intelligence has accelerated our capacity to control, initiate, and stage warfare. Troops have been replaced with drones on the frontlines, and we are not far from the automatic kill execution of autonomous machines. The Terminator is an inevitable outcome, no different from the nuclear bomb: it is an inevitability resulting from competition and thirst for competitive advantage.

While there is much coverage about the management and controls being put into place for these new digital and machine intelligence technologies, the implementation of them in military and central banking functions continue to accelerate unhindered under the guise of national security. In effect, there are no controls put into place for the entities that arguably play the most pivotal roles in the Fourth Turning.

Preparing for the Inevitable

This section really commands its own separate article as the methods can become complex, but the following is a general overview of how one can prepare for the incoming reset. Keep in mind that these cycle turnings unfold over a period of years, not days or months. The good news is that there is still time, but the bad news is that its slow moving nature lulls many to sleep and complacency until they wake up to a bad new headline and it is simple too late.

First and foremost, one must prepare one’s mindset to withstand the stress and hardships that will be faced. Strengthening the will, resiliency, and getting to know oneself from within are critical steps in preparing for what is to come. Ultimately, you want to become the master of the material world and not be a slave to it - achieving this enables you to take control and be proactive while at the same time be able to weather whatever is thrown at you, no matter what the roll of the dice in life is. This is where FoFty’s principles and manuscript can provide structure and pathways towards mastering oneself. It is in fact why I have decided to embark on this journey and travel together with you on the bridge to the next version of the world.

Then, one must convert one’s existing assets into a medium that can carry through to the next financial regime while diversifying income streams and reducing reliance to a single job or career path. Acquiring physical gold and to some extent Bitcoin will serve as protection and transportability into the next regime as gold, for example, has survived numerous rise and falls of empires and currencies since the Egyptian and Roman times. It is the only currency that has outlasted empires over many thousands of years and will likely continue to do so. Bitcoin, as a digital variant may prove to be the same but as it is still relatively new and not as time-tested. Bitcoin has been around for 15 years while gold has functioned as a currency for over 2,500 years. That kind of a gap in time-tested evidence cannot be underestimated if one were to be intellectually honest with oneself. As such, allocation into Bitcoin should be much smaller. Consider it as a speculative safe-haven play, if that makes sense. Diversification is key, even when it comes to insurance.

Similarly, don’t rely on that steady or cushy job and believe it will last until your retirement. When the reset occurs, it will happen in a flash and within a couple of news headlines, your career will easily get turned upside down. Once again, diversification is key and developing alternative income streams and talent will protect you and your family from disaster while providing options as the new world emerges. Remember, it was Kiichiro Toyoda’s resiliency and ability to pivot that enabled him to turn what was once a loom production company into one of the world’s largest automobile manufacturers.

Finally, there is a physical component one must prepare for, and that is to have an outlet from a crowded metropolis if you find yourself living in one. You don’t have to be a billionaire and build million dollar bunkers in New Zealand to implement this. All you have to do is to research areas of the world that aren’t too far from you that have low strategic commodity or military value and see what the visa requirements are to setup shop. Create these pathways and have them ready so that when the time comes, it is all about execution and not about planning. Planning during a crisis leads to low quality decisions and loss of situational awareness. Ask any astronaut or pilot and they will agree.

I will be sharing more on this topic as it is an important application of FoFty principles as we navigate this increasingly complex and dangerous world. If you find this article helpful, please do like and share your thoughts in a comment.

One can talk a lot but be a faker and not walk the talk. I’ve resigned from my job, established another base in a safe haven, converted all my assets, written a manuscript, and created a media channel to show that I’ve started walking, and continue to walk.

Come walk with me.

➡️ Watch the accompanying YouTube video for this article here:

It is overt that we have been living for almost a century within a financial structure that rests on nothing and which in turn supports and feeds an economic system that has long been highly unsustainable. Fiat money - with no underlying - is an absurdity, a lie that we have decided to make into truth, but which is bound to collapse in the long run. The central banks' maneuvers on interest rates have now become a clumsy way of covering up this mise-en-scene, but by now the blanket is getting shorter and shorter. To make matters worse, the world population is growing rapidly: eight billion people at present. All in a capitalist-consumerist system that induces us to buy, consume rapidly and then repeat a cycle that aims at the continuous growth of nations' turnover and GDP...but to get where? It is clear that the endpoint can only be the implosion of the system itself.

I was just checking out NZ for the exact reasons you mentioned. See you in NZ. or CR.